Ethylene costs rebound in Asia but little support for the downstream PE market

Ethylene costs rebound in Asia but little support for the downstream PE market

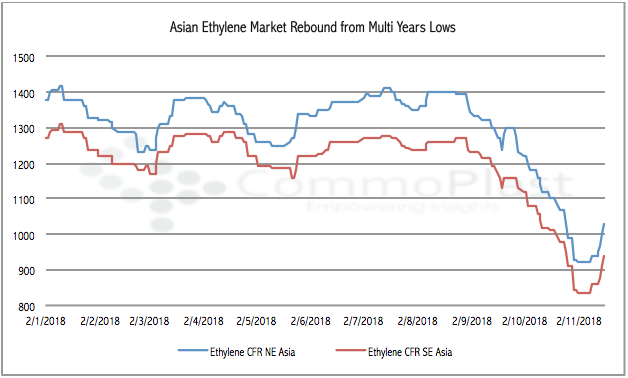

The Asian ethylene market fell to the multi-years low levels during the first week of November on the back of lengthy supply and soft demand from most downstream markets. However, the market recovered some losses over the past week, with Northeast Asia value jumped $110/ton while Southeast Asia value running behind at $105/ton.

It is reported that some Chinese ethylene buyers are returning to the spot market for fresh replenishment following the delay to restart at some local crackers. In fact, Shanghai SECCO Petrochemical Co Ltd decided to postpone the restart at its 1.09 million tons/year cracker in Shanghai, China to the beginning of December, about two weeks later than the initial plan. The company shut the entire petrochemical complex for an annual turn around on 8 October and was planning to restart by the second half of November.

However, the recovery in ethylene costs has not created any immediate support to the downstream PE market, which continues to remain on the soft track on the first trading day this week.

It is important to note that Middle Eastern makers have not announced new prices and most offers available at the moment are USA origins. In Vietnam, import LLDPE film originated from the USA remains in the range $1000-1050/ton CIF Vietnam, LC 0-90 days term.

“In the meantime, sellers are collecting bids for other origins. We are hoping to achieve deals for Southeast Asian HDPE film at below the $1150/ton threshold this week,” a Vietnamese converter said.

In China, there has been movement in the import PE market with deals for Indian LLDPE film reported at $1000/ton CFR China term. However, buyers are rather cautious about new purchases. “We also receive Brazilian LLDPE film at $980/ton CFR China today. This origin is not very regular, hence we need to consider carefully our purchases,” a trader reported.

The rebound in the upstream ethylene costs alone might not create a big impact on the market immediately, yet, sources started looking at the horizon for the possible successful negotiation between China and the USA to ease the trade tension between the two countries.

“Would the meeting between the two leaders sees some positive outcome, the market might regain its strength. As a result, we do not plan to wait for too long before new purchases,” a Southeast Asian buyer added.