Weekly PVC Overview - Week 47 - 2018

Weekly PVC Overview - Week 47 - 2018

December shipment offers moved higher. Indian buyers showed great acceptance while others remain reluctant

Week 47, dated 19 - 23 November 2018

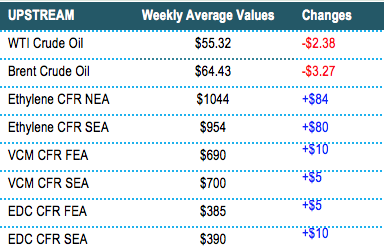

In Asia, major overseas producers announced December shipment offers mostly at higher levels month on month following the trend pioneered by the Taiwanese maker. There has been a great contrast in term of acceptance among the regional buyers, however, the market is not very optimistic about the near to medium term outlook.

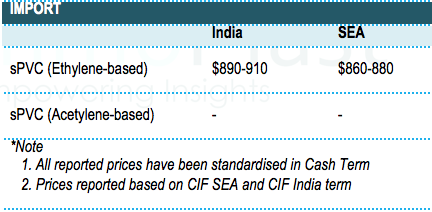

In India, the Taiwanese major sold out all available allocation very quickly at $890-900/ton CIF, LC AS term. Demand in India improves visibly this time as a result of the end of the monsoon season and also low inventories on manufacturers’ hands. “We do feel positive about the near-term outlook. In the meantime, we are watching out for the next movement in the upstream market as the plunge in the energy complex has affected the sentiment to a certain extent,” a distributor informed.

Meanwhile, Southeast Asian buyers are rather reluctant to accept the new prices. As the monsoon ended in India, it is starting at part of Southeast Asia market. “Besides, buyers tend to keep low inventories levels approaching the year-end season. We are lifting the new offers anyway,” a Thailand producer commented.

In Vietnam, duty-free Japanese cargoes are gaining traction at $860/ton CIF Vietnam, LC AS, sources reported. “We would wait for a couple of days more before making decision. Local buyers are unable to accommodate new hike, hence it is important to select the right cargoes,” a local trader in Vietnam said.

On the other hand, there have been reports that the Chinese government is encouraging local PVC producers to increase the export quantity the remaining of the year. Rumor has it that an export target has been given of approximately 100,000 tons, however, the information has not been verified at the time this report is published.

“This could create some supply crunches in the local ground in the coming months. We shall expect the market to hit the cyclical bottom and might not witness any major reduction in the near-term,” a Chinese trader commented. This week, carbide-based PVC remains stable at the range CNY6400-6450/ton ($795-801/ton without VAT) and ethylene-based PVC dropped CNY100/ton ($15/ton) to CNY6800-7000/ton ($845-870/ton without VAT), all based on EXW China, cash term.

In related plant news, China General Plastics Corporation (CGPC) is planning a weeklong maintenance shutdown at its 400,000 tons/year PVC unit in Linyuan, Taiwan in January 2019.

A summary of import PVC prices to the region is shown in the following table: