Escalating local PVC market in China might support import ground

Escalating local PVC market in China might support import ground

PVC (A) k67-68 SPVC k67-68

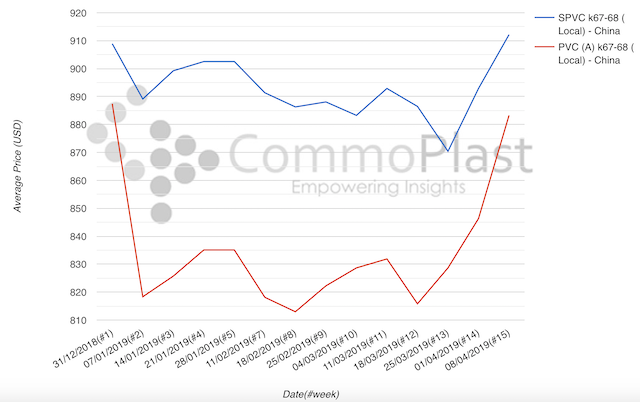

For three weeks in a row, the local carbide-based PVC market in China has escalated strongly thanks to the tightening supply condition and higher production costs. Based on CommoPlast Price Index, the average carbide-based PVC price based n EXW China, excluding VAT term surge nearly $70/ton since late March, fast approaching the levels observed at the beginning of the year.

Players informed that carbide costs have increased drastically in recent days leaving carbide-based PVC producer no choice but to increase prices to recoup the production costs. A series of chemical plant explosion occurred in March has prompted the government to conduct strict safety inspections, forcing many chemical plants to reduce operating rate.

“The explosion at Xinjiang Yihua carbide plant [on 8 April 2019] adds more upward pressure on the carbide prices. We think the uptrend in PVC market might persist in the near term,” a carbide-based PVC producer added. In 2017, an explosion also occurred at the 900,000 tons/year carbide plant belong to Xinjiang Yihua Chemical Group, killed 2 people.

At the moment, the price gap between ethylene-based and carbide-based PVC is the narrowest since the beginning of 2019, at less than $30/ton.

Players are waiting for overseas producers to announce May shipment offers and Chinese customers believe that the current local market condition could halt the much-expected reduction in the import market.

“Of course we have to look out for the demand condition in other markets such as India and Southeast Asia. But we think suppliers are having support not to cut prices too much,” a Chinese trader added.

It is reported that deals for USA PVC to China have reached $810-820/ton CFR China term this week.