Local PVC market in China continues to surge. Would import ground gain support to firm up?

Local PVC market in China continues to surge. Would import ground gain support to firm up?

Domestics PVC prices in China are now at multi-month high levels all thanks to the tightening supply condition. The strict safety inspection following explosions at several chemical plants has forced many companies to step back on operating rate as a precaution measure, which curtails availability.

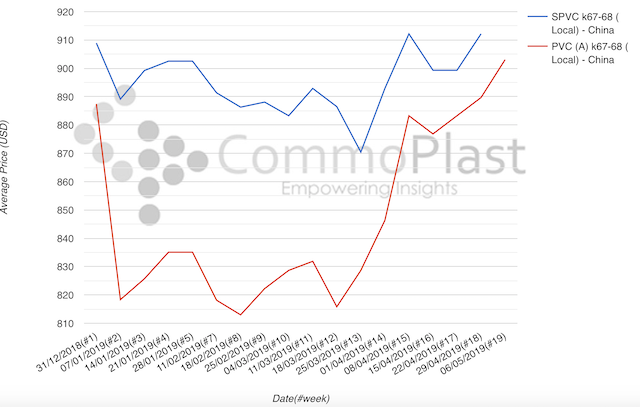

According to CommoPlast data, carbide-based PVC based on EXW China term has surged nearly $100/ton since mid of March while ethylene-based PVC jumps about $70/ton.

The continuous hike has not supported the import ground in the previous month when May shipment offers from overseas sellers reached the lowest levels since 2016. The plunge in the import offers, however, only a mild effect on the local ground. As the market revived from such minor impact, sources are expecting to see overseas sellers to lift June shipment offer in the coming week.

“We sold a very good quantity to China market this month at a premium compared to other markets. Demand is strong here. We might continue to put more attention on China market in the near term,” a Southeast Asian producer said.

Besides the China market, it is reported that demand in India is also picking up. A major local producer in India has been maintaining a firmer stance on the spot offers and introduced INR1000/ton ($14/ton) hike on 9 May 2019. Asian players take this as an assurance that overseas sellers would attempt to match the hike in the coming week.

“Healthy demand in China has provided some support and with India market start pacing up, we think overseas sellers would implement $20/ton increased for June shipment offers,” an Indian trader commented.

On the other side, the escalated trade war between China and the USA casts doubt on the market. However, market players are silently waiting for the effect on the market to show.