Asia Daily PP PE Report 20 Jan 2016

Asia Daily PP PE Report 20 Jan 2016

In China, the firming trend observed in the futures trade on Dalian Commodity Exchange in the past few days has started to loose momentum, with PP futures posted only CNY13/t gain today while LLDPE futures advance CNY55/t. Contract number 1605 settled at CNY5882/t ($765/t without VAT) for PP and at CNY8195/t ($1065/t without VAT) for LLDPE.

Spot offers in local market for both PP and PE are unchanged from the earlier trading session; however, trading activities are slowing down, according to market players. A trader in Xiamen reported, “We think that buyers have completed pre-holidays replenishment activities and expecting slower sentiment as the week ending. Some of our customers have started to close for Chinese New Year this week and we expect demand will only pickup again in March.”

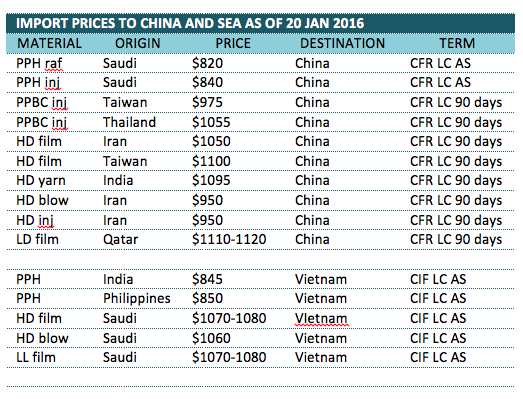

There is very little movement observed in the import market today with overseas sellers are maintaining very firm stance on their prices, which players attributed to the absence of inventory pressure. A Shanghai trader offers Thailand and Taiwan PP block copolymer at $975/t and $1055/t respectively, CFR China, LC 90 days said, “Our principals are very firm on their offers but we are not optimistic about the market outlook in the coming week.”

In Southeast Asia, sentiment has not shown any improvement with most offers remain unchanged from yesterday. Vietnamese players reported that a major Thailand producer has suspended their PE offers to this market due to weak demand. A trader said, "Due to falling energy prices, local buyers become very reluctant to proceed with purchases. Besides, Chinese New Year is around the corner; hence we expect sentiment to be weaker in the near term. We received offer for Thai materials but didn't replenish any quantity because we still have some inventories in hand." Another international trader inform that their Thailand principal prefers to sell to other markets outside Southeast Asia for better earnings. The source added, “We received offer for Thailand HDPE film at $1160/t FOB to Africa and $1140/t FOB to Europe this week. Our supplier is not willing to sell at lower price in Asia at the moment.”

A similar scenario is observed in the PP market with buyers showing a diminished interest level in import cargoes pointing to volatile energy market and availability of competitive local parcels. Market players in Philippines complain about sluggish demand condition despite one of the major PP makers in the country is having maintenance shutdown. A trader said, “Local material is very competitive now, yet buyers are not having the urge to make purchases. We see local makers are now more open to the export market as they can earn better margins.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us at commoplastinfo@gmail.com for assistance.