Domestic homo-PP prices in Indonesia drop three-digits on resistance buyer

Domestic homo-PP prices in Indonesia drop three-digits on resistance buyer

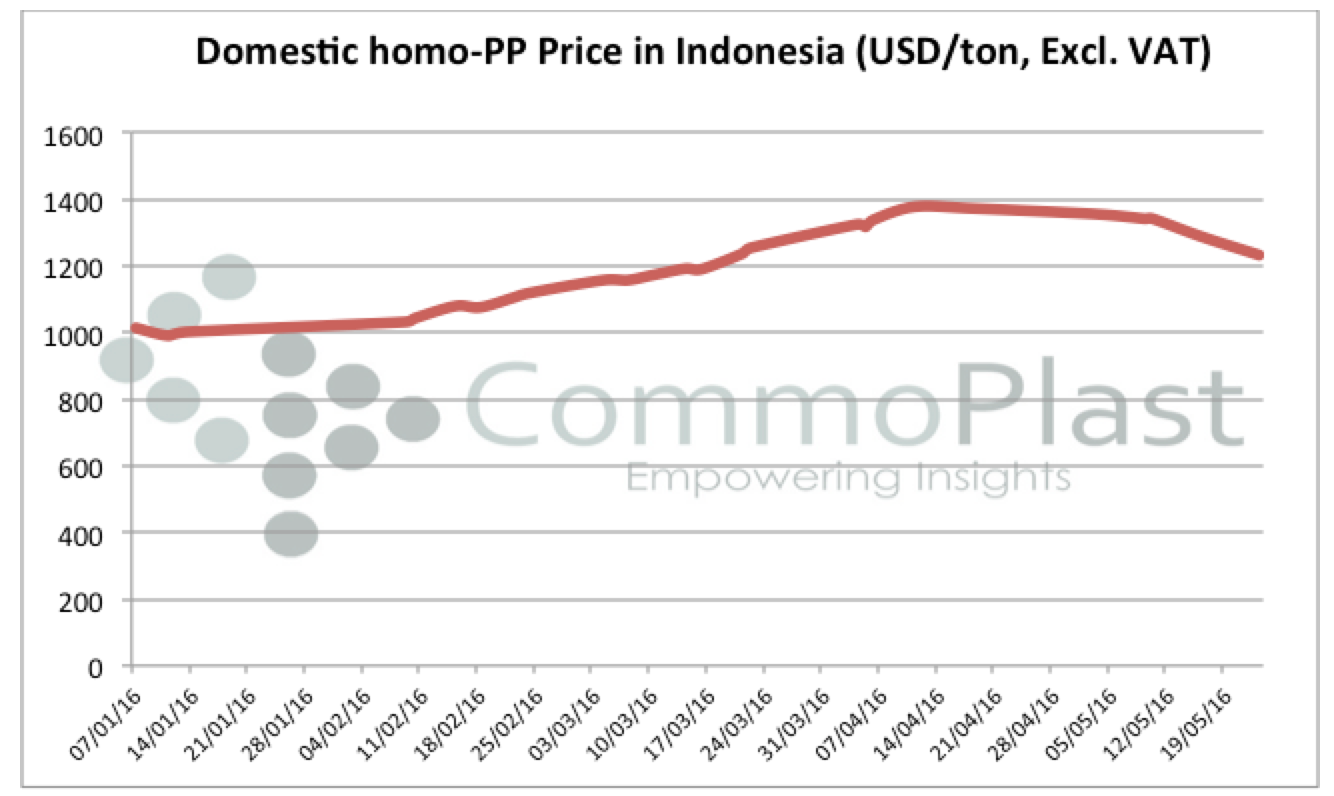

The PP market in Indonesia has been firming up for four months in a row starting early January 2016, accumulating a total of USD365/ton gains during the period.

Data combined by CommoPlast showed that the increasing speed peak out during second week of April 2016 before it takes a downturn in early May 2016. At the time this report is published, domestic homo-PP prices in the country has plunged USD150/ton from the peak last month. Absence of demand is blamed for such rapid price erosion.

Explaining on the slow down in buying appetite, several converters informed that they have anticipated the firming trend; hence most of replenishment activities took place during February and March period. Moreover, with the impending fasting month in June, many buyers are cutting production rate, in which less material is required.

A household product manufacturer said, “We are currently operating at 50-60% capacity due to diminishing end product demand. We prefer to buy from import market on need basis as prices are much more competitive than domestic prices.”

Another converter whose end products supplied mostly to the sugar industry commented, “We have stocked up three months worth of inventories since March, and at the moment we are planning to replenish some cargoes for mid-June delivery. Demand for our end product is expected to remain healthy till 3Q, yet we have no intention to buy in large quantity.”

Even with the reduction in official price list, distribution market is now seeing even more discounts as trader’s move to entice demand with a source said, “Domestic prices have been increasing too quickly in the past months and therefore buyers turn to import cargoes to cut costs. We think market might only revive after the Ramadan month given expected weaker end product demand during fasting month.”

Supply in the country has not improved due to several shutdown at major regular regional suppliers, however buyers have elected to wait and see, preferring to buy on need basis with hope to obtain more discounts in the near term. June outlook is not as promising, market participant said.