Asia Daily PP PE Report 21 Jan 2016

Asia Daily PP PE Report 21 Jan 2016

In China, futures contract on Dalian Commodity Exchange for May delivery continue to advance today with PP futures increased CNY35/t ($5/t) to close at CNY5932/t ($770/t without VAT) while LLDPE futures also gain CNY5/t to close at CNY8215/t ($1065/t without VAT).

Spot offers for both PP and PE in the local market remain unchanged from yesterday, however, players are reporting calmer trading activities as buyers are preparing to go off for Chinese New Year holidays. A trader from Zhejiang said, “Local inventory has been absorbed considerably in the past few days thanks to strong replenishment interest. Although sentiment is weaker today, we expect local sellers to adjust their offers up in the near term due to lack of inventory pressure.”

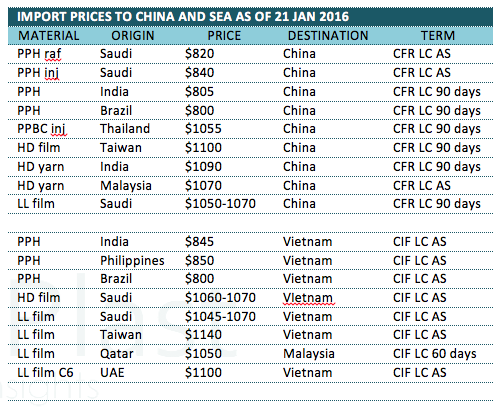

In the import market, overseas sellers are holding very firm stance on their prices claiming tight availability in spite of plunging upstream markets. A Southeast Asia producer commented, “We manage to concluded some HDPE yarn cargoes at $1070/t CFR China but we see the demand is not very strong. We do not expect to see any drastic swing in PE prices in the near term.”

In Southeast Asia, the PE market sees no changes with sellers are very reluctant to give large discount pointing to good demand in China as support. Another major Saudi maker has announced February shipment prices for PE to Vietnam with $20-30/t higher than last offer to reach $1070/t for HDPE film and $1080/t for LLDPE film, CIF LC AS term. Meanwhile, one more Saudi maker has decided to give only $10/t discount on their offers given earlier this week to conclude deal at $1060/t for HDPE film and LLDPE film, CIF Vietnam. A buyer informed, “We only order one container for each grade as we feel there is a strong pressure on ethylene costs which might also affect the downstream pricing. Local market is turning more quiet now as players are preparing to go off for Chinese New Year.”

The PP market is also steady with no radical movement observed today. There is an offer for irregular Brazilian homo-PP at $800/t CIF term, yet very few buyers actually show interest due to the unpopularity of this origin. A Southeast Asian maker commented, “The incident at one of the PP plant in UAE might not affect the market so much as local supply for PP in most countries within Southeast Asia is sufficient. We see some interest in Vietnam market, as buyers are in need to replenish their stock. We are still monitoring further market movement to have a clear outlook in the coming month.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us atcommoplastinfo@gmail.com for assistance.