Import LLDPE film defied weakening ethylene costs to follow stronger trend

Import LLDPE film defied weakening ethylene costs to follow stronger trend

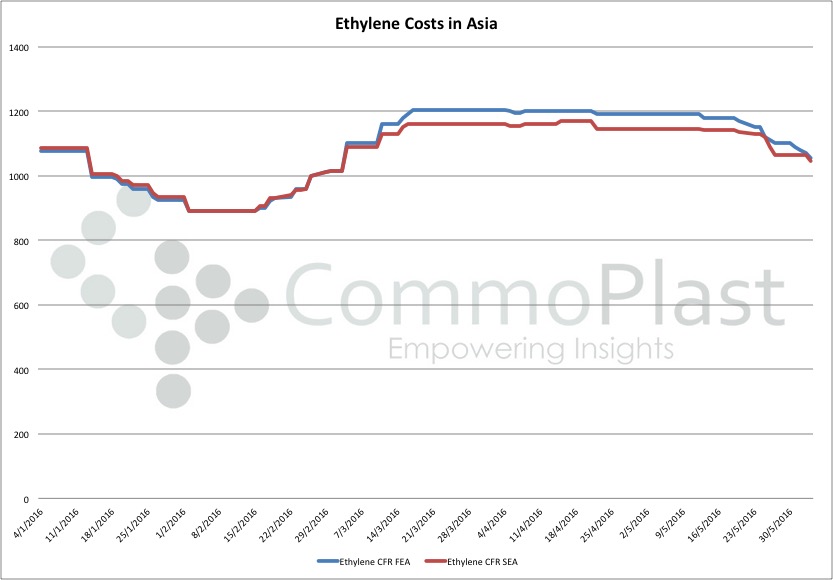

Ethylene prices in Southeast Asia market has been steady following the weakening trend since mid-May on the back of improved supply and declining demand from the downstream derivatives.

CommoPlast data shows ethylene based on CFR Southeast Asia term on an average fell $45/ton from earlier week to settle at $1045/ton last Friday – the lowest level since beginning of March 2016. Market players are expecting further reduction in the near term with Indonesia’s Chandra Asri achieved full operation rate at its newly expanded naphtha cracker while Thailand’s PTT resumed production at its 1 million ton/year cracker after maintenance shutdown. More ethylene cargoes coming from Middle East is set to pressure the market amid falling demand from PVC and PE sector.

The PE market meanwhile under downward pressure since early May as peak seasonal demand for agriculture film ended, bring along weaker sentiment. This week, import LLDPE film finds its way to rebound from the recent depression with the support from limited supply, stemming from several major production issues. A buyer in Vietnam received Iranian LLDPE film at $1100/ton CIF Vietnam, LC AS term, some $30/ton higher than last week said, “Our supplier is very firm on their prices this week even we place bid to purchase some quantity at previous levels. Supply for this grade in domestic market is also not sufficient, therefore we are planning to buy a small quantity to sustain the buffer stock.”

Another buyers informed receiving Saudi Arabia LLDPE film for June delivery at $20/ton higher than initial offer, to reach $1170/ton CIF Vietnam, LC AS term. The source added, “Another Saudi Arabia supplier is also very firm on their cargoes at $1160/ton with the same term claiming tight availability. We are holding some previous cargoes at higher cost, and we prefer to wait for a while longer before offering to the market with hope to reduce loses.”

Regional players believed that the recent rebound in import LLDPE film prices might be constraint by the falling upstream costs, while the beginning of the fasting month in Muslim countries could limit a certain extent of demand.