Morning Briefing - 26 May 2022

CommoPlast

Morning Briefing

26 May 2022

Brent: $114.03 (+ $0.47)

WTI: $110.33 (+ $0.56)

Naphtha CFR Japan: $876 (- $11)

Ethylene CFR NEA: $1070 (- $30)

Ethylene CFR SEA: $1120 (- $30)

Propylene FOB Korea: $1060 (- $15)

Propylene CFR China: $1040 (- $10)

*Data represent closing prices on the previous day.

……………………………………………………………….

It came as a surprise to many Vietnamese customers that a key South Korean producer decided to slash import homo-PP offers to below the $1200/ton threshold despite having achieved deals earlier this week in the range of $1220-1230/ton CIF Vietnam. The latest price cuts sent the Vietnamese homo-PP market to the lowest level since late December 2021, and the four cyclical bottoms before that. But could the market rebound from here? At least Vietnamese buyers are happier to make replenishment at $1180-1190/ton based on CIF terms.

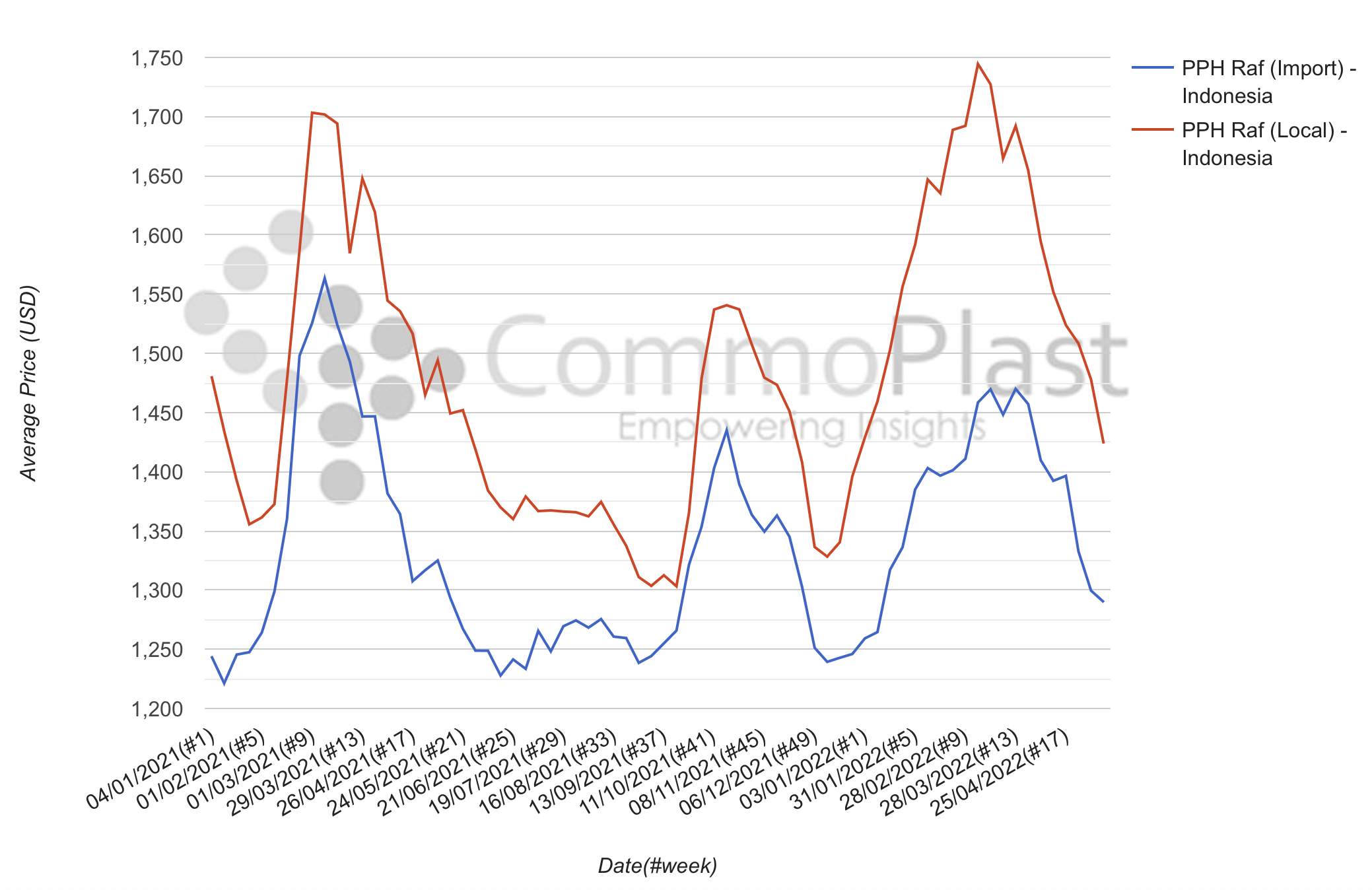

Meanwhile, for Indonesian customers, both local and import homo-PP offers are still not attractive enough to trigger bottom fishing activities. Firstly, end-product businesses are still weak, and secondly, the location gap with Vietnam is too wide. The market is off on Thursday, but buyers expect further reductions when they are back.

……………………………………………………………….

Earlier this week, a major Saudi Arabia producer slashed import LLDPE film offers to China by $70/ton, causing a lot of ‘wow’ across the region. Well, more ‘wow’ by the second half of the week as the same producer put up another $30/ton discount, totalling the reductions to $100/ton week-on-week, to close deals at $1120/ton CFR China.

For local Vietnamese traders, who received offers from the same producer for the same cargoes at $240/ton above the deal levels in China, one of the biggest fears is that Chinese players would decide to re-export the lower cost stocks, crushing any chance to lift local prices in the medium terms. “To minimise such a probability, we are asking the supplier to substantially reduce the location gap between the two markets,” a Vietnamese trader added.

……………………………………………………………….

In related industry news, the Indonesian government has zerorised the tariffs on import PET and HDPE from China with effective 1 April 2022. Other PE grades, PP, and PVC, however, continue to face a 5% duty when imported to Indonesia. It remains to monitor if Chinese suppliers would leverage this opportunity to exploit the Indonesian HDPE market, especially as China added a good number of new capacities in recent years.

______________________________________________________________

Follow us on CommoPlast Official Telegram Channel for more: https://t.me/commoplast

Your empowering market insight site.